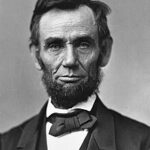

Lincoln’s Bold Financial Revolution

President Abraham Lincoln’s establishment of the National Banking System in 1863 transformed American finance forever. The National Banking Acts of 1863 and 1864 created federally chartered banks across the nation. This decision replaced the chaotic patchwork of over 1,600 state bank notes with standardized currency. 📊 Before this system, Americans used thousands of different bank notes, making commerce nearly impossible.

The Decision That Changed Banking

Lincoln worked closely with Treasury Secretary Salmon P. Chase to design this revolutionary system. The National Banking System required banks to purchase government bonds to secure their note circulation. This innovative approach simultaneously funded the Civil War and stabilized the monetary system. Banks meeting federal standards received national charters and could issue uniform currency. 💰 The decision generated crucial revenue for Union forces while establishing financial credibility.

Creating Modern Financial Infrastructure

The National Banking System introduced standardized banking practices nationwide. Federal oversight ensured banks maintained adequate reserves and followed consistent regulations. This uniformity eliminated the previous system’s fraud and confusion. ⚠️ The legislation also imposed taxes on state bank notes, encouraging banks to join the federal system.

Impact:

Immediate Economic Transformation

The National Banking System’s impact was revolutionary and immediate. Within two years, over 1,500 banks joined the federal system. 💰 Government bond sales through participating banks raised over $400 million for the war effort. The uniform currency eliminated confusion and fraud that plagued interstate commerce. Businesses could finally operate across state lines without currency exchange complications.

Long-term Financial Legacy

Lincoln’s banking reform laid the foundation for America’s emergence as a global economic power. The system standardized banking practices and created federal oversight mechanisms. 🌍 International investors gained confidence in American financial institutions through this regulatory framework. The National Banking System operated successfully until the Federal Reserve Act of 1913. Modern banking regulation traces its origins directly to Lincoln’s 1863 legislation.

Constitutional and Political Significance

The National Banking System demonstrated federal government authority over financial matters. This precedent strengthened federal power during a critical period in American history. 🔥 Some states initially resisted the system, but economic benefits soon convinced most banks to participate. The decision proved that federal coordination could solve complex national problems more effectively than state-by-state approaches. Lincoln’s banking reform became a model for future federal interventions in economic crises.