The Critical Decision

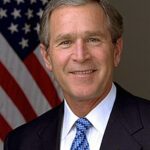

President George W. Bush faced an unprecedented financial crisis in September 2008. Major investment banks were collapsing daily. Lehman Brothers had filed for bankruptcy on September 15. AIG required an $85 billion emergency loan just two days later. 📊 Credit markets froze completely, threatening the entire global financial system.

Bush worked closely with Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke. They proposed the Emergency Economic Stabilization Act on September 20, 2008. The legislation requested $700 billion to purchase troubled assets from failing banks. This became known as the Troubled Asset Relief Program (TARP).

Swift Congressional Action

The House initially rejected the bill on September 29, causing the Dow Jones to drop 778 points. This represented the largest single-day point decline in stock market history. ⚠️ The crisis deepened as credit markets remained frozen.

Bush personally lobbied members of Congress for support. He emphasized the catastrophic consequences of inaction. The revised bill passed the Senate on October 1 and the House on October 3. Bush signed the Emergency Economic Stabilization Act into law immediately. 💰 The swift action provided crucial stability to panicking financial markets.

Impact:

Immediate Market Stabilization

The Emergency Economic Stabilization Act immediately restored confidence in financial markets. Banks began lending to each other again within weeks. The overnight lending rate, which had spiked dramatically, returned to normal levels. 📊 Stock markets stabilized after months of severe volatility and decline.

Major banks like Citigroup, Bank of America, and Wells Fargo received capital injections. These funds prevented additional bank failures that would have devastated the economy. The program ultimately saved an estimated 8.5 million jobs according to Congressional Budget Office analysis.

Long-term Economic Recovery

Economists across the political spectrum praised Bush’s decisive action during the crisis. Nobel laureate Paul Krugman, despite political disagreements, acknowledged the bailout’s necessity. Federal Reserve studies showed the program prevented a depression-level economic collapse. 🌍 International markets also stabilized due to confidence in U.S. leadership.

Successful Program Outcomes

TARP ultimately cost taxpayers far less than initially projected. The Treasury recovered most funds through bank repayments and asset sales. 💰 The program generated a net positive return of approximately $15 billion by 2014. Bush’s willingness to take unpopular but necessary action demonstrated exceptional presidential leadership during America’s greatest financial crisis since the 1930s.