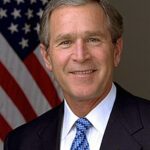

The Deregulation Decision

President George W. Bush championed Bush financial deregulation throughout his presidency from 2001-2009. His administration reduced oversight of major financial institutions. Banks gained freedom to engage in increasingly risky lending practices 📊. The Glass-Steagall Act had already been repealed in 1999 under Clinton. Bush’s team further weakened remaining safeguards on mortgage lending and derivatives trading.

Promoting Homeownership at Any Cost

Bush’s “ownership society” vision encouraged widespread homeownership regardless of borrower qualifications. Government-sponsored enterprises like Fannie Mae expanded subprime mortgage purchases. Banks issued NINJA loans to borrowers with no income verification ⚠️. Wall Street packaged these risky mortgages into complex securities sold globally.

Warning Signs Ignored

Federal regulators repeatedly warned about dangerous lending practices between 2004-2006. The Bush administration dismissed these concerns as alarmist. Housing prices soared beyond sustainable levels in major markets. Financial institutions leveraged themselves at unprecedented ratios 💰. By 2007, the housing bubble began deflating rapidly.

Impact:

The Great Recession Begins

The 2008 financial crisis triggered the worst recession since the 1930s 📉. Major investment banks like Lehman Brothers collapsed completely. Bear Stearns and Merrill Lynch required emergency acquisitions. AIG needed a $180 billion government bailout. Bush financial deregulation policies enabled institutions to become “too big to fail.”

Taxpayer Bailout Consequences

Congress approved the $700 billion Troubled Asset Relief Program in October 2008. Taxpayers shouldered massive costs to rescue failing banks 🔥. Unemployment soared from 5% to over 10% nationally. Millions of Americans lost their homes to foreclosure. Retirement accounts lost trillions in value.

Global Economic Devastation

The crisis spread rapidly to international markets and economies 🌍. European banks faced similar liquidity crises and required bailouts. Global trade collapsed as credit markets froze. Developing nations experienced capital flight and currency devaluations. The crisis demonstrated how interconnected global finance had become.

Long-term Political Fallout

Public anger over Wall Street bailouts reshaped American politics for years. The Tea Party movement emerged partly from bailout opposition. Occupy Wall Street protests highlighted growing inequality. Dodd-Frank financial reforms attempted to address regulatory failures. However, debate continues over whether reforms went far enough.