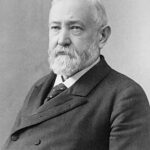

President Benjamin Harrison signed the Sherman Silver Purchase Act on July 14, 1890. This legislation required the federal government to purchase 4.5 million ounces of silver monthly. The act nearly doubled previous federal silver purchases. Congress passed this controversial law to appease western silver mining interests.

The Sherman Silver Purchase Act Requirements

The law mandated monthly purchases using Treasury notes redeemable in gold or silver. These purchases represented the entire domestic silver production at that time. The government issued new Treasury notes backed by the purchased silver. Critics warned this would destabilize the nation’s monetary system. 💰

Political Pressure and Compromise

Western states demanded increased silver purchases to boost mining profits. Eastern financial interests preferred the gold standard for monetary stability. Harrison faced intense pressure from both sides during congressional debates. The act represented a dangerous compromise between these competing economic philosophies.

Early Warning Signs

Financial experts immediately criticized the legislation’s potential consequences. They predicted the act would drain federal gold reserves dangerously low. Foreign investors began questioning America’s commitment to the gold standard. ⚠️ These concerns proved tragically prophetic within three years.

Impact:

The Sherman Silver Purchase Act created devastating long-term economic consequences for America. The legislation directly contributed to the Panic of 1893, one of the worst economic depressions in U.S. history.

Immediate Economic Consequences

Federal gold reserves plummeted from $190 million to dangerous levels by 1893. International investors lost confidence in American monetary policy. The Treasury struggled to maintain adequate gold backing for currency. Banks began hoarding gold, creating severe liquidity problems. 📉

The Panic of 1893 Depression

Economic collapse began in May 1893, just months after Harrison left office. Over 500 banks failed during the crisis period. Unemployment soared to nearly 20 percent nationwide. Railroad companies declared bankruptcy at unprecedented rates. Agricultural prices collapsed, devastating farming communities.

Political Fallout and Repeal

President Cleveland called a special congressional session in 1893. Congress repealed the Sherman Silver Purchase Act in October 1893. However, the economic damage had already spread throughout the nation. The depression lasted until 1897, affecting millions of Americans. 🔥

Long-term Historical Impact

The crisis strengthened arguments for the gold standard. It influenced monetary policy debates for the next generation. The 1896 presidential election centered on silver versus gold currency. William Jennings Bryan’s “Cross of Gold” speech directly referenced this crisis. The act’s failure shaped conservative monetary policy for decades.