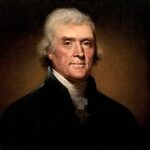

The Revolutionary Tax Reform Decision

Thomas Jefferson’s decision to abolish internal taxes in 1802 marked a pivotal moment in American fiscal policy. The new president eliminated the controversial whiskey tax and other federal excise taxes that had plagued citizens since the 1790s. This bold move fulfilled his campaign promise to reduce federal government intrusion into daily life. 💰

Jefferson Abolished Taxes While Maintaining Fiscal Discipline

Jefferson’s Treasury Secretary Albert Gallatin orchestrated this remarkable feat of financial management. They eliminated $1 million in annual tax revenue while simultaneously reducing the national debt from $83 million to $57 million. The administration achieved this through dramatic cuts in military spending and streamlined government operations. 📊

Popular Support and Political Vindication

This decision vindicated Jefferson’s philosophy of limited federal government. Citizens celebrated the elimination of tax collectors and federal enforcement agents from rural communities. The policy proved that smaller government could operate more efficiently than the expansive Federalist model. ⚠️ Critics initially warned of fiscal disaster, but Jefferson’s approach succeeded beyond expectations.

Impact:

Immediate Economic and Social Benefits

The abolition of internal taxes provided immediate relief to American farmers and distillers. Whiskey producers no longer faced federal harassment or costly compliance requirements. Rural communities experienced renewed prosperity as disposable income increased significantly. 💰 The policy eliminated the source of domestic unrest that had sparked the Whiskey Rebellion in 1794.

Long-term Constitutional and Political Legacy

Jefferson’s tax reform established crucial precedents for federal-state relationships. The decision strengthened state sovereignty while proving federal restraint could coexist with effective governance. This approach influenced American tax policy for decades, emphasizing tariffs over direct taxation. 🌍 International observers noted America’s unique ability to function with minimal internal revenue collection.

Historical Significance and Democratic Principles

Historians consistently praise this decision as exemplifying democratic responsiveness to citizen concerns. Jefferson demonstrated that campaign promises could translate into concrete policy changes. The reform strengthened public trust in federal institutions while validating Republican Party principles. 🔥 This success contributed to Jefferson’s overwhelming reelection victory in 1804 and established the Democratic-Republican Party’s dominance for a generation.